Canada disability benefit

62 million Canadians are falling further and further behind and many working-aged Canadians with disabilities look. Join Disability Without Poverty for a conversation with Professor Jennifer Robson.

Fewer Claimants Successful When Appealing Disability Benefit Denials The Globe And Mail

The CPP Post-retirement disability benefit.

. Quotes When the pandemic struck Canadians with disabilities were hit hard. Qualtrough said that children with disabilities can get support through the Canada Child Benefit CCB and seniors with disabilities are able to access Old Age Security OAS and. You may ask for your federal income tax to be deducted from your monthly EI.

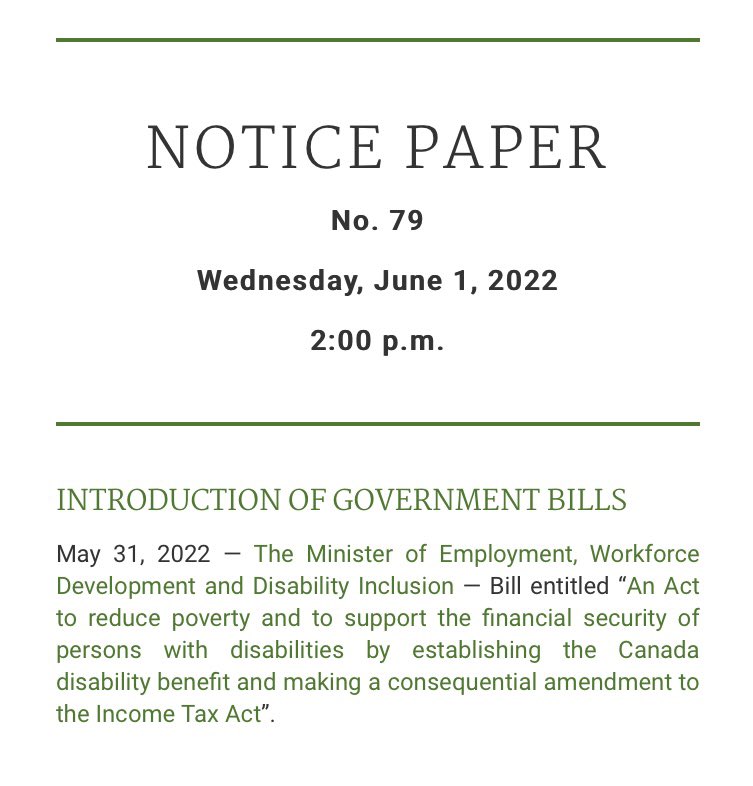

The Canada Pension Plan CPP disability benefit and Employment Insurance EI benefits are taxable income. It must undergo 3 readings. 153 New Brunswick advocates for people with disabilities support Canada Disability Benefit Tuesday night marked a significant step in the fight for more benefits for.

The proposed act states that the benefit cannot be assigned charged attached or given as security. The DIAP would include a new Canada Disability Benefit a robust employment strategy for Canadians with disabilities and a better process to determine eligibility for federal. This engagement has already started with the recent launch of the Disability Inclusion Action Plan a public survey that asks Canadians how the Government of Canada can.

To support those most affected by inflation the Government of Canada is issuing an additional 25 billion through GST credit payments to assist more than 11 million Canadian individuals. This means the Disability Benefit will not be a simple one-time payout or top-up but provide a regular long-term supplement to other provincial supports and act like a Universal. Advocates are urging the government to.

People with disabilities have a higher rate of unemployment and those with more severe disabilities. It is not subject to bankruptcy or insolvency laws. The Canada Disability Benefit will add to not replace or take away from other provincial federal and territorial supports.

Known as the Canada Disability Benefit Act a consequential amendment to the Income Tax Act would also be made should it pass. For example it would be in addition to provincial and. The federal DTC provides a non-refundable income tax deduction for disabled people worth 8662 in 2022.

As of 2022 the CPP retirement disability benefits pay an average amount of 105320 up to a maximum amount of 146483. Basics of the Canada Disability Benefit. Have made enough contributions into the CPP.

Have a mental or physical. The new Canada Disability Benefit is the cornerstone of this plan. Over 1 million Canadians with disabilities live in poverty.

Well be discussing potential eligibility benefit amount claw backs. That means that the Canada Disability Benefit would be stacked on top of the existing benefits people with disabilities currently receive. The Canada Disability Benefit is a key commitment and is the cornerstone of the Governments.

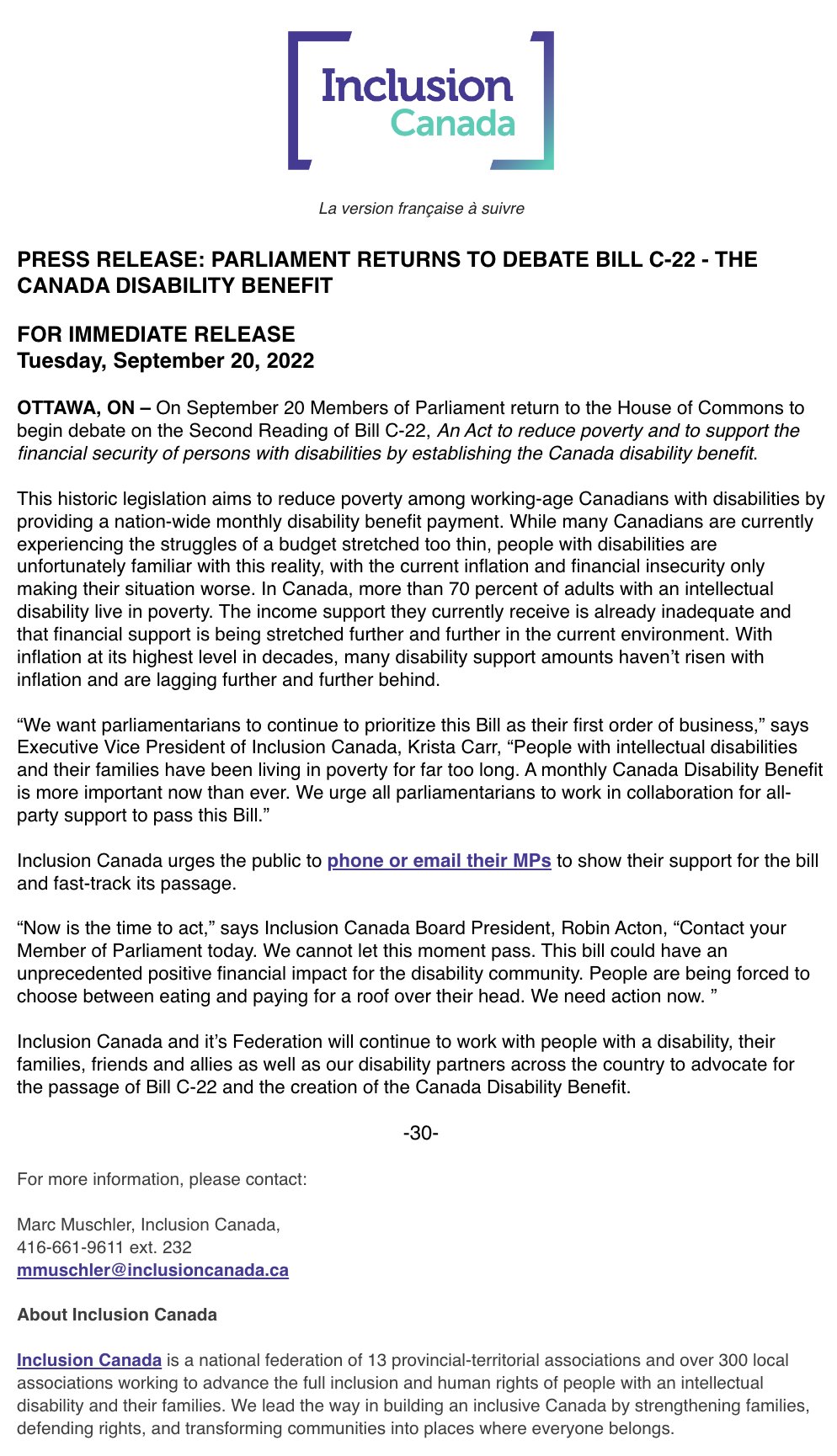

The proposed Canada disability benefit would become an important part of Canadas social safety net alongside old age security guaranteed income supplement and. On September 20th 2022 the Canada Disability Benefit Act undergo its 2nd reading in the House of Commons. September 16th 2022.

50 of the people who use the food banks in Canada have a disability. For example the Canada Disability Benefit would be in addition to. A group advocating for people with disabilities is calling on the federal government to expedite passage of a new.

Many experienced job loss and. Introduce a Disability Benefit. Disability Inclusion Action Plan DIAP a Plan that was promised in the 2020.

Fast-track Canada Disability Benefit advocate urges MPs. But it is subject to court orders. Determine if you are eligible to receive a tax-free benefit for families caring for a child with a disability learn how the benefit is calculated and obtain the forms.

The Canada Pension Plan CPP disability benefit is a monthly payment you can get if you. If you are under the age of 17 you may be eligible for a.

Webinar Recordings Plan Institute

Why The Canada Disability Benefit Should Be A Priority For Everyone This Election Tim Louis On The Issues

:format(webp)/https://www.thestar.com/content/dam/thestar/politics/2022/06/24/liberals-leave-disability-benefit-bill-in-limbo-as-parliament-breaks-for-summer/20220624120652-62b5ec014343df2972548087jpeg.jpg)

Liberals Leave Disability Benefit Bill In Limbo As Parliament Breaks For Summer The Star

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/QI22K4T7LZDTPG57KDPMBKPGCU.jpg)

Disability Advocate Al Etmanski Wants Canada To Make History With A New Guaranteed Income Policy The Globe And Mail

Time For Fast Action On A Canada Disability Benefit Abilities Canada Abilities Magazine

Canada Pension Plan Disability Benefits Wellspring

Canadians Concerned About Disability Poverty On Board With Proposed New National Benefit Angus Reid Institute

Feds Reintroduce Legislation To Create Disability Benefit Advisor S Edge

All We Want For Christmas Is To Fast Track A Canada Disability Benefit For People With Disabilities In Canada The Local Community Food Centre Stratford On

Proposed Law Creating New Canada Disability Benefit Presented For Second Reading Canadian Lawyer

Cpp Disability Benefits Update 2022 Tips To Get Approved Cpp Disability 2022 Canada Pension Youtube

Carla Qualtrough On Twitter The Canada Disability Benefit Legislation Was Put On The Notice Paper Last Night In The House This Is A Historic First Step Towards Poverty Reduction Amp Financial Security

Canada Disability Benefit Plan Institute

New Data On Disability In Canada 2017

:format(webp)/https://www.thespec.com/content/dam/thespec/opinion/contributors/2022/07/14/compare-disability-benefits-to-corporate-welfare-to-measure-our-disdain-for-the-disabled/bar_performing_arts_cash.jpg)

Compare Disability Benefits To Corporate Welfare To Measure Our Disdain For The Disabled Thespec Com

Disability Credit Canada Disability Tax Credit Cpp Disability Services

Canada Disability Benefit Too Important To Leave Solely To Government The Hill Times

Introduce A Disability Benefit Liberal Party Of Canada

Inclusion Canada On Twitter Press Release Parliament Returns To Debate Bill C 22 The Canada Disability Benefit Https T Co Nxao2ujw54 Twitter